Quattro Group

Quattro Group

Alberts was created in Auckland in 2020 to invest in B-grade office and create value by monetising the workplace culture gap across an entire building, now we win awards with our model.

A new economic model for office that is sustainable, delivers office as a desired destination and captures the value of workplace culture to drive asset performance.

A New Office Economy

Today and moving forward, there are

significant challenges when it comes to how

our customers approach their workspaces.

Our target market demands aspiration,

collaboration, sustainability and

community, the 4 keys aspects of the modern

workplace, often termed Hybrid.

We are ahead of the challenge, creating a new

office class and economic model, Green H-Premium, to meet our customers demand for

new workplaces that capture the true

meaning of Hybrid.

We execute a “brown to green” investment

strategy, delivering workplaces in existing

buildings that are aspirational, sustainable,

experience driven and are deeply valued by

our customers.

We understand workplace culture and the

market opportunity between traditional office

and the new. We deliver a new economic

model for office which is demand driven and

delivered via a closed economy model that

optimizes revenue.

We’ve re-created existing buildings into high performance award-winning investments.

Our unique knowledge of office uses non

traditional data and we create customer offers

that are attractive in terms of amenity, design

and importantly sustainability.

Our brand grabs the attention of our target

market, ensuring Alberts remains top of mind. Our core marketing theme is the creation of FOMO, ensuring a following and disrupting the status quo of office.

Our flagship, 1 Albert Street, is an award

winning asset that sets new revenue

parameters: it disrupts the traditional

economic model of office.

Quattro Alberts

Quattro Alberts is an operator of and investor in office buildings. We acquire assets, reposition and upcycle, create revenue and fully manage office buildings. Our current portfolio is worth $700m at completion.

Our inspiration is to create the office as a desired, sustainable destination for our customers. A core belief is that the greenest buildings are the buildings we already have.

Our focus is on the new economic of office, we are innovative but measured in creating value. This means listening, understanding and prioritising our customers’ satisfaction by actively engaging with the physical asset, developing an aspirational design, being accountable and delivering an ESG driven outcome.

We manage capital to optimise our investment partners returns by combining a focus on the economic with governance and sustainability. Our core belief is to protect capital and we do this by ensuring that the expectations of our key customers, the tenants, are met.

Our stabilised assets operate at levels not achieved by the traditional office model. Our track record means we are favoured by lenders and admired by our competitors.

The Church Bell, FOMO and WFH

At Alberts, our phenomenal experiences turns the workplace into a highly desired destination for our customers, the tenants.

This is driven by the four key pillars of Green H-Premium: Aspiration, Community, Collaboration and Sustainability. Our customer products are a combination of market research, a high performing leasing strategy, aspirational workspaces and a shared economy, based on the world’s best work clubs, with exceptional amenities, service and community.

Alberts creates a strong community with a customer focus led by our concierges, marketing, programming, private events and collaborative spaces.

As part of the new economic model, we have developed workplace products that offer our customers the elements they need to thrive in simple to acquire packages:

1. Agile Suites – 2 to 6 pax (up to 5% of NLA)

2. Private Suites – 6 to 50 pax (up to 40% of the NLA)

3. Bespoke – 20 to 250 pax ( the rest of the NLA)

4. Traditional – ok, we do play the old way as well (kind of)

And we develop new products to meet our customers needs and market changes. We are a deep thinker about the future of workplaces.

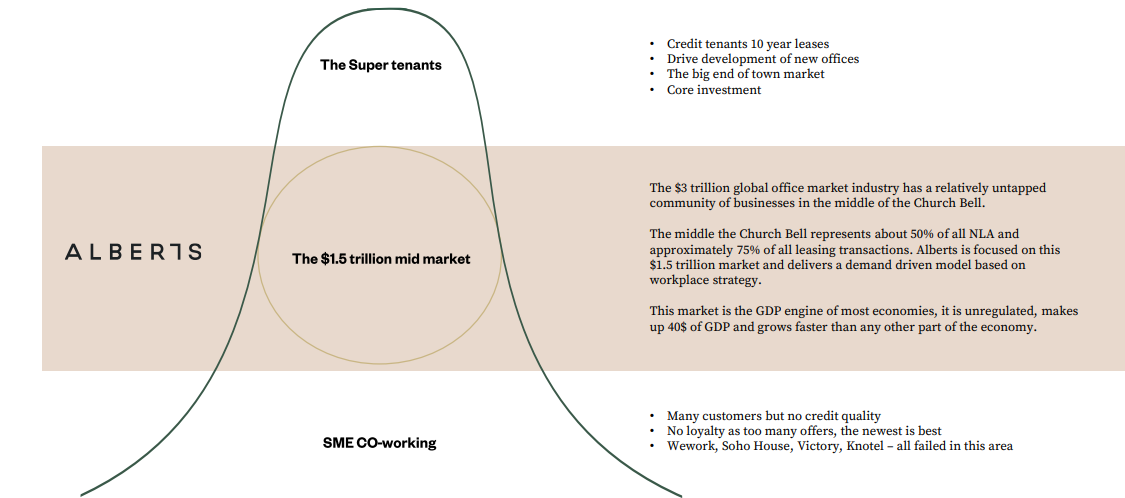

The $3 trillion Church Bell: A New Paradigm

The Super tenants

• Credit tenants 10 year leases

• Drive development of new offices

• The big end of town market

• Core investment

The $1.5 trillion mid market

The $3 trillion global offices market industry has a relatively untapped community of businesses in the middle of the Church Bell.

The middle the Church Bell represents about 50% of all NLA and approx 75% of all leasing transactions. Alberts is focused on this $1.5 trillion market and delivers a demand driven model based on workplace strategy.

This market is the GDP engine of most economies, it is unregulated, makes up 40% of GDP and grows faster than any other part of the economy.

SME CO-working

• Many customers but no credit quality

• No loyalty as too many offers, the newest is the best

• Wework, Soho House, Victory, Knotel – all failed in this area

The Super tenants

• Credit tenants 10 year leases

• Drive development of new offices

• The big end of town market

• Core investment

The $1.5 trillion mid market

The $3 trillion global offices market industry has a relatively untapped community of businesses in the middle of the Church Bell.

The middle the Church Bell represents about 50% of all NLA and approx 75% of all leasing transactions. Alberts is focused on this $1.5 trillion market and delivers a demand driven model based on workplace strategy.

This market is the GDP engine of most economies, it is unregulated, makes up 40% of GDP and grows faster than any other part of the economy.

SME CO-working

• Many customers but no credit quality

• No loyalty as too many offers, the newest is the best

• Wework, Soho House, Victory, Knotel – all failed in this area

ESG; The best buildings are old

Of all greenhouse emissions in New Zealand are contributed by built environment, most of which is CO2

Internationally, building construction and use are responsible for…..

of embodied carbon emissions in a building are associated with the su-structure, frame, upper floors and roof. Well designed and executed upcycling works can retain these elements..

The case is starkly illustrated by a study of our refurbishment at 1 Albert Street, Auckland. Over a 60 year period there would be a…

greater carbon footprint impact if 1 Albert Street were to be built on a like-for-like basis, rather than refurbishing and upcycyling, even if the new build may be more operationally energy efficient.

Our carbon credentials helped contribute to our BEST IN CATEGORY: Commercial Office at the Property Industry awards.

ESG Decarbonisation Strategy

We’re committed to creating a lasting legacy of high-quality, upcycled assets that excel in both sustainability and financial performance. Our approach is rooted in comprehensive lifecycle planning, guided by our robust ESG credentials and strategies. We actively seek opportunities to collaborate with our customers, supporting their ESG goals and community initiatives.

Our prudent capital management strategy is designed to safeguard investments throughout market cycles while identifying optimal moments to divest assets and reinvest capital. This forward-thinking approach ensures we deliver enduring value to our stakeholders while championing environmental responsibility and community engagement.

The workplace culture gap

Quattro Alberts’ core focus as an investor, operator and partner

Acquisition

• Tired, inefficient assets, with poor ESG, with appropriate features,or

• New assets that are not well leased or are not performing to underwrite.

• Attractive emerging locations supported by infrastructure and new investment.

• Off market assets that offer ability for a well managed capital structure.

• Support “brown to green” and Alberts H premium workspace execution.

• Focus on capital relationships outcomes, governance and profit, be resilient in protecting capital and targets.

Upcycling

• Vacancy and short WALT allows restructuring to H Premium.

• Last 8% of NLA can be reconfigured cost efficiently to FOMO share economy.

• Deep dive market understanding of the revenue church bell opportunity.

• Design early, driven by economics, demand and design quality, at a known cost

• Sustainability is core, recycle and repurpose within an overall lifetime ESG plan

• Deliver a better outcome for our partners

Alberts Experiences

• Customer focused, know our customers, who they are and how to communicate with them.

• Create attractive workspaces, both in design and economically, for our customers.

• Keep it simple, one price that is all inclusive and easy to use.

• Our customer experiences are core, whether it is the workspace, the community or events, we endeavour to meet our customers expectations.

• We evolve constantly through research

Sustainability

• Create a legacy of quality upcycled assets that will stand the test of time in terms of sustainability and financial performance.

• Endeavour to extend assets useful life’s through life cycle planning driven by our ESF credentials and strategies

• Be aware of opportunities to work with our customers to support there ESG and

community credentials

• Manage capital through cycles to protect capital invested and seek opportunity to exit assets in order to recycle capital.

Meet our team

The Quattro team numbers over 60 staff, with backgrounds including Blackstone, CBRE and JLL. This real estate experience is complimented by a digital marketing team, hospitality operations and brand creation, with these experiences combining to bring together the Quattro Alberts strategy execution.

Andrew Saunders

CEO

Andrew established Quattro in 2007 in a joint venture with Mulpha Group, with a PERE strategy that successfully invested in the Park Hyatt, Sydney, amonst other assets. In 2012, Mulpha Group interest was acquired and Quattro entered the US market, buying Record Realty $3bn US office portfolio for $50m with backing from the Los Angelos based Saban Group. In 2015, Quattro partnered with Morgan Stanley Real Estate Investment to acquire assets in Auckland.

Later, Alceon joint ventured with Quattro to invest in the Alberts Office strategy. In total, Andrew has acquired and successfully managed over $1bn of NZ office, $3bn of US office and $2bn in Australia. He has worked in the UK, Singapore, the US and ANZ. He founded Macquarie Banks platform in Asia, led Challengers Group US and UK investment and has a range of experience to deliver Quattro Alberts to a global platform.

Luke Condon

Chief Commercial Officer

Luke has 25 years real estate experience across global markets in PERE, cross border investment in the UK and France, and leasing advisory at Thor Equites and Knight Frank.

Mark Gedye

Managing Director – New Zealand

20 years real estate experience specializing in the activation of commercial office towers including feasibility analysis, transaction management and property management.

Contact Us

Contact Form

"*" indicates required fields